Take advantage of ATO $20k Instant Asset Write-Off

Dear Clients + Customers,

As the financial year end approaches, we want to remind you of the valuable $20,000 Instant Asset Write-Off offered by the Australian Taxation Office (ATO). This incentive allows businesses to immediately deduct the cost of eligible assets costing less than $20,000, reducing your taxable income and boosting your cash flow.

Key Points

- Eligible Assets: New and second-hand assets costing less than $20,000.

- Applies To: Businesses with an aggregated turnover of less than $10 million.

The $20,000 threshold will apply on a per asset basis, so small businesses can instantly write off multiple assets. - Deadline: Small businesses will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2025.

Don’t miss out on this opportunity to enhance your business while maximizing your tax deductions.

Lear more via the ATO website here.

Kind Regards,

Anthony Mirabile

Financial Accountant for Beyond Tools

Our productsShop BT EOFY Flyer

Save £346.00

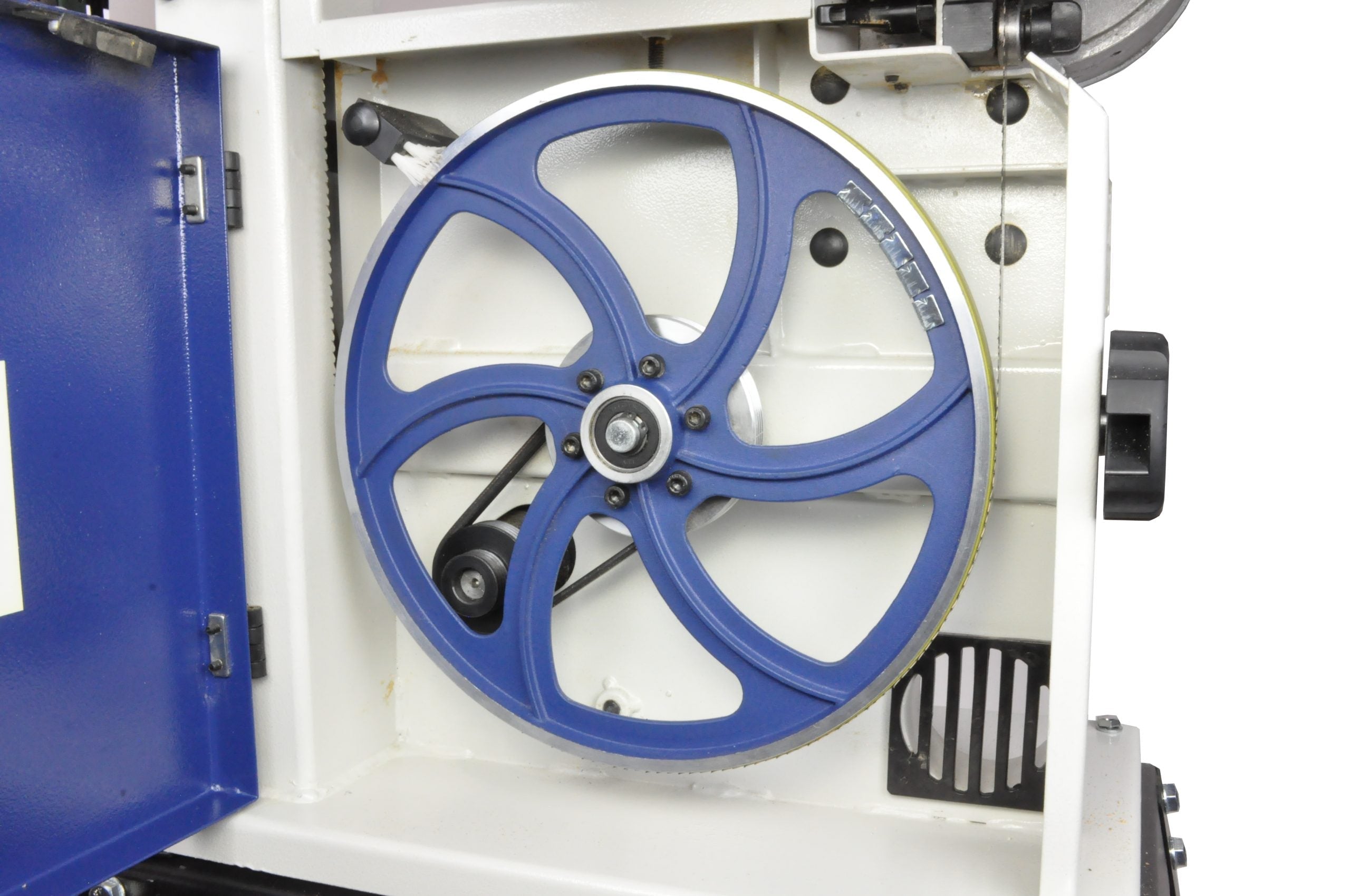

Rikon

350mm (14″) Bandsaw with Cast Iron Fence 10-324TG by Rikon

Sale price£745.00

Regular price£1,091.00

In stockSave £20.00

Midwest

Offset Aviation Snip 3Pce Set MWT-6510RLS by Midwest *Limited Edition Promo*

Sale price£54.00

Regular price£74.00

In stockSave £16.00

Woodfast

4Pce Woodturning System & Carbide Insert Cutters WFT70-800 by Woodfast

Sale price£128.00

Regular price£144.00

In stockSave £373.00

Rikon

350mm (14″) Deluxe Bandsaw with 2820mm x 4-19mm Blade with Storage Cabinet 1.5HP 240V 10-326 by Rikon

Sale price£904.00

Regular price£1,277.00

In stockSave £22.00

OX

Folding Saw Horse (2Pce Set) 800mm OX-T335575 by OX

Sale price£74.00

Regular price£96.00

In stockSave £12.00

Oltre

Anvis Heavy Duty SG Iron Steel Anvil and Vice Combo by Oltre

Sale priceFrom £78.00

Regular price£90.00

In stockSave £10.00

Oltre

Carving Tool Set 6Pce OT-CTS-6 by Oltre *New Arrival*

Sale price£27.00

Regular price£37.00

In stockSave £287.00

Rikon

315mm (12.5”) Swing x 510mm (20”) Between Centres Variable Speed MIDI Lathe 70-220VSR by Rikon

Sale price£458.00

Regular price£745.00

In stockSave £96.00

Rikon

25mm (1") x 1067mm (42") Belt & 200mm (8") Disc Sander 50-144 by Rikon

Sale price£213.00

Regular price£309.00

In stock